Art as an Investment: The Canvas of Financial Opportunity

Steps to Effectively Invest in Art

Weekly writing about the art market and the convergence of art and technology. By day, I’m a partner at the Robert Fontaine Gallery and a data science consultant. By night, I write Artxiom, ideas at the intersection of art, technology, and finance.

If you haven’t subscribed, join today by subscribing here:

Art as an Investment: The Canvas of Financial Opportunity

We are living in economically uncertain times, and financial experts continue to forcast a grim outlook of what is to come. People are understandably seeking ways to safeguard their financial future through more diversified portfolios. As a result, art has emerged as a compelling alternative investment option, attracting both seasoned investors and newcomers to the art market. Unlike traditional stocks and bonds, art offers a unique blend of aesthetic pleasure and potential monetary gain, making it an intriguing avenue for portfolio diversification, one of the many reasons why corporations decide to build art collections.

The art market has shown remarkable resilience and growth over time. This can be attributed to the globalization of the art market in recent decades, increased transparency through online platforms like Artnet and Artsy, and growing wealth in emerging markets, leading to new collectors. High-profile sales, such as Leonardo da Vinci's "Salvator Mundi" (Figure 2) fetching $450 million in 2017, have catapulted art into the spotlight as a serious investment consideration. One of the primary advantages of art investment is its potential for high returns. Rare pieces by renowned artists can appreciate significantly in value, sometimes outperforming traditional market investments. Historical data shows that fine art has outperformed many traditional investment classes over long periods. According to available data compiled by Masterworks, from 1995 to 2020, contemporary art prices outpaced the S&P 500 by 174%. Over this period, the S&P 500 appreciated 9.5% a year while contemporary art prices appreciated 14% per year on average (Figure 3), almost two-fold the S&P 500 over the same period.

Moreover, the art market tends to operate independently from stock fluctuations, providing a hedge against economic downturns and inflation. It is also often considered "currency neutral", meaning artworks tend to retain high resale value even during economic downturns. Such fortitude stems from the art market's self-regulating nature, where supply and demand dynamics help maintain relatively stable prices, even during financial turbulence.

In addition, the art market's resilience is evidenced by its quick recovery following economic downturns. After the 2008 financial crisis, the art market rebounded faster than many traditional markets. Art also offers tangible ownership, a feature that appeals to investors seeking physical assets. Unlike digital investments, art can be displayed and enjoyed while potentially accruing value. This dual benefit of aesthetic pleasure and financial growth sets art apart from many other investment vehicles.

However, art investment comes with unique challenges. The market is largely unregulated and can be opaque, making it difficult for newcomers to navigate. Authenticity, provenance, and artwork condition are crucial factors that can significantly impact an artwork's value. Additionally, art is generally illiquid, meaning it can be challenging to sell quickly without incurring losses. Successful art investment requires a deep understanding of art history, current market trends, and future projections. Investors must consider additional costs such as storage, insurance, and conservation. The subjective nature of art also means that tastes and trends can dramatically influence value, adding an element of unpredictability.

Despite these challenges, the art market continues to attract investors. The rise of online platforms, galleries, art fairs and art funds has made art investment more accessible to a broader audience. These developments, coupled with the increasing global wealth and the desire for alternative investments, suggest that art will likely continue to play a significant role in investment portfolios and the price will continue to rise. Take for example Andy Warhol, who in May 2022, broke record for the most expensive work of art sold at auction by a Post-War or Contemporary artist when his “Shot Sage Blue Marilyn, 1964” (Figure 4) sold for $195 million at Christie’s New York. It solidified his position at the top of the art market, maintaining a path that has led the value of his work to consistently outperform leading financial markets, including the S&P 500, over the past two decades (Figure 5).

In conclusion, art as an investment offers a unique proposition: the potential for financial gain coupled with the pleasure of owning beautiful and culturally significant objects. While it requires careful consideration and expertise, art investment can provide diversification, potential high returns, and a hedge against market volatility. As with any investment, thorough research and professional advice are crucial for those looking to add art to their investment strategy.

Below, you will find crucial steps to effectively invest in art:

Define Your Investment Goals

Defining your investment goals is a crucial first step for successful art investment. Take into consideration the following points:

Understand whether you are investing in art primarily for financial appreciation (long-term value growth), portfolio diversification, or personal enjoyment and appreciation (enhancing your living space or investing for emotional or cultural purposes)

Define clear and measurable financial goals. For instance, are you looking for a specific return of investment (ROI) percentage within a certain timeframe?

Determine your investment timeline. Are you considering buying a piece to resell quickly or investing in a piece expecting it to appreciate over time?

Assess your risk tolerance. The art market can be volatile, so understanding how much risk you are willing to take is essential.

Do Your Research

If you want to invest in art, you have to understand the art market. It is important to familiarize yourself with how the art market operates:

Research key players in the art world (famous collectors, galleries, auction houses, art institutions, museums, art fairs, etc) and familiarize yourself with the art they are showing or buying to get a feel for the market. Art exhibitions, art fairs, and auction houses are good places to observe prices.

Research market trends to identify which genres, artists, or movements are gaining popularity and could potentially yield a return.

Look into historical performance data for artworks similar to those you are interested in, as this can inform your expectations about future performance

Create an Investment Strategy

Once you have done your research, it is time to create an investment strategy:

Decide on the artists whose work you want to invest in, focusing on emerging artists, mid-career artists, or stablished masters based on your comfort level and research

Determine which medium (paintings, sculptures, photography, multi-media, prints and multiples, etc) and style you are drawn to and believe hold investment potential

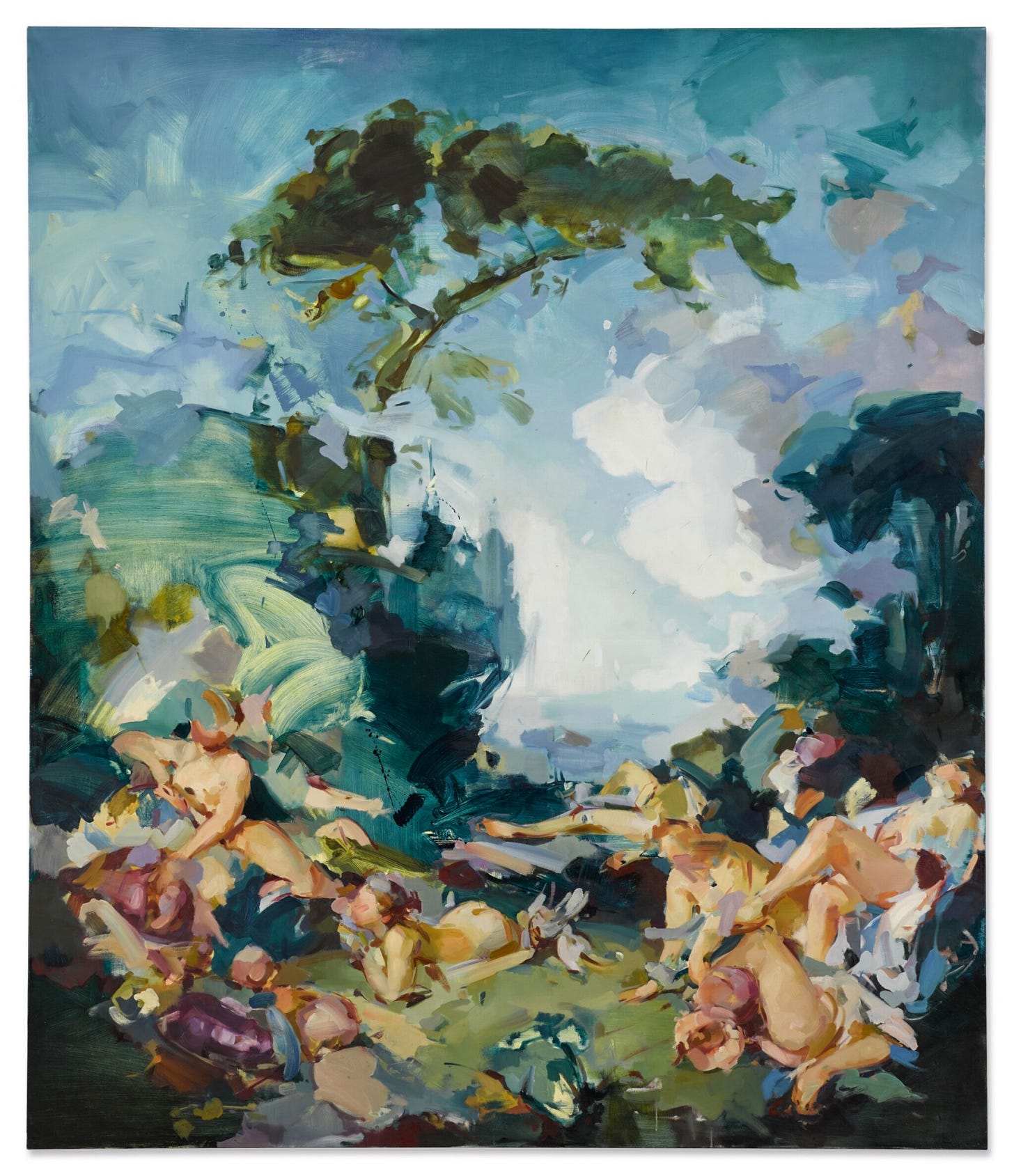

Take into consideration that if you want to invest in emerging artists, their prices are usually more affordable but the risk is higher; however, the ROI can be potentially big if the demand for the artist rises. For instance, let’s look at the market of rising young star Flora Yukhnovich, who in 2019, her paintings were selling between $3,000 and $40,000. Since April 2021, the artist has had more than 40 lots come up at auction, all of which sold for over the estimate value, with 10 for over $1 million and an average ROI of aproximately 400% since 2019. Her auction record is $3.6 million for “Warm, Wet ‘N’ Wild” sold at Sotheby’s in 2022 with an estimate between $200,000 and $260,000 (Figure 6).

On the other hand, if you decide to invest in mid-career artists or stablished masters, their prices are usually higher but the risk is lower, meaning there will usually be a ROI when you decide to sell since these artists already have a solid market in place, for example, Andy Warhol, Ellsworth Kelly, Frank Stella, etc.

Diversify your collection. Consider investing in artworks across different styles, periods, and mediums to spread risk and maximize potential returns.

If you decide to focus on mid-career artists or stablished masters but their prices are too high for your budget (prices for unique pieces), consider investing in prints and multiples from these artists. The global market for this sector is estimated to be valued at $6 billion, expected to reach $10 billion by 2030 with huge investment potential (We will discuss this topic in depth in next week’s article).

Set a Budget and Acquisition Strategy

Set a clear budget for purchasing art that aligns with your overall investment strategy

Decide how much you are willing to spend on individual pieces.

Consider additional costs. Account for expenses such as insurance, storage, restoration, and potential transaction fees like taxes and shipping costs.

Explore various acquisition methods, such as attending gallery exhibitions, art fairs, and auctions.

Consult With Art Professionals

Engage with art advisors. Seek guidance from experienced art advisors who can provide insights on market trends, artist reputations, and investment opportunities.

Get artworks professionally appraised to determine their value and authenticity.

Buy From Reputable Sources

Purchase artworks from established galleries, reputable auction houses, and verified online platforms to ensure authenticity.

Don't be afraid to negotiate prices.

Manage and Monitor Your Art Collection

Maintain proper documentation. Keep detailed records of your art collection, including purchase prices, provenance, and condition reports.

Insure your collection. Protect your art investments by securing appropriate insurance coverage to safeguard against damage, loss, or theft.

Evaluate and adjust goals regularly.

Routinely, review the performance of your art investments against the goals you have set.

Be willing to adapt your strategy based on market conditions and your evolving interest

Stay Informed and Engaged

Continuously follow art market news, sales reports, and artist developments to make informed decisions.

Attend art events and networking opportunities. Participate in art-related events, fairs, and exhibitions to expand your network and stay connected with the industry.

In summary, by clearly defining your investment goals, you lay a solid foundation for navigating the art market effectively. Each step helps ensure that your investments not only resonate with you personally but also align with sound financial strategies for potential future growth. If you would like assistance with your art investment needs, you can always get in touch with us via email or phone call. We are more than happy to guide you and offer you the best advice.

Happy Investing!

Thanks for reading! Subscribe here to receive Artxiom in your inbox each week: